Treat Time With Respect and Prosper.

Treat Time With Respect and Prosper.: October 01, 2015

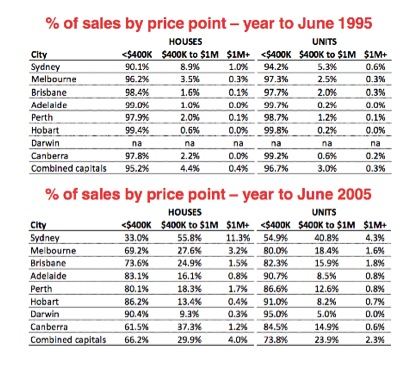

Across capital cities, 25.1% of home sales were under $400,000, 60.1% were between $400,000 and $1 million and 14.8% were in excess of $1 million.

Twenty years ago 95.2% of all capital city houses and 96.7% of units sold for less than $400,000. Meanwhile, only 0.4% of all houses and 0.3% of all units sold transacted for more than $1 million.

(Cameron Kusher CoreLogic RP Data.)

What this information is confirming is that it is getting harder and harder to buy property in Australia. It is also telling us that the longer we wait to take the plunge, the more out of reach the housing opportunity will be. More and more we are seeing the median house price inch its way to the million dollar mark. As a first time buyer, this is a truly unattainable proposition.

The first time buyer needs to look for practical strategies to launch him or her into their property experience. One of the most under utilized way of doing this is to team up with someone and forge an unstoppable force. Combine deposits, halve mortgage repayments and all associated costs with buying and owning a home.

Co buying is a strategy and as such, can be manipulated to suit the co buyers. Treating the transaction like a business proposition will see it succeed and build a strong foundation from which to build. The minimum partnership should last at least two years, then if agreed, sell, take the profits and go on to buy your own house with a sizeable deposit. Better than this though, is to buy again. Take the equity and buy again…and rent.

Take heed, you must invest in a co buying contract to protect all parties. So study the statistics carefully and draw your own conclusions and if you can find a better strategy to co buying, please let me know!